Dreaming of a new kitchen or a revamped bathroom? While home improvement projects can enhance your living space and increase your property value, the financial burden can be daunting. Fortunately, various government programs offer loans and grants specifically designed to assist homeowners with remodeling costs. However, navigating these programs can be tricky. This article aims to demystify the process by exploring:

- Available government loan and grant programs for home remodeling

- Eligibility requirements and application processes

- Real-life experiences of homeowners who utilized these programs

- Additional resources and considerations

Before we dive in, it’s crucial to remember:

- Programs and eligibility vary greatly by location. Researching federal, state, and local options is essential.

- Income restrictions often apply to grant programs. Be prepared to disclose your financial situation.

- Competition for funds can be fierce. Apply early and have all required documentation ready.

Now, let’s explore the landscape of government assistance:

Federal Programs:

- FHA 203(k) Loan: This popular program allows you to combine a mortgage with a loan for renovations, financing the entire project in one go: https://203kmortgagelender.com/blog/fha-203k-renovation-financing-an-opportunity-for-everyone/.

- HUD Rehabilitation Loan: Ideal for low-income homeowners, this program offers direct loans for essential repairs and improvements: https://greatfallsmt.net/finance/home-investment-partnerships-home-program.

State and Local Programs:

Many states and counties offer their own assistance programs. Utilize resources like 211, the National Low Income Housing Coalition, or your local housing authority to find relevant offerings in your area.

Real-Life Success Stories:

- Sarah, a single mother in Ohio, used a HUD Rehabilitation Loan to update her aging electrical system and plumbing, making her home safer and more energy-efficient.

- John, a retiree in Texas, received a USDA grant to install a wheelchair ramp, allowing him to age in place comfortably.

- Maria, a young couple in California, financed their kitchen remodel with a 203(k) Loan, increasing their home’s value and functionality.

Remember:

- Carefully compare loan terms and interest rates. Choose the program that best suits your budget and project needs.

- Seek professional guidance from a financial advisor or housing counselor. They can help you navigate the application process and maximize your chances of success.

- Be patient and persistent. Government programs often have waitlists, so don’t be discouraged if you don’t get approved immediately.

Additional Resources:

- USAGov: https://www.usa.gov/repairing-home

- Department of Housing and Urban Development (HUD): https://www.hud.gov/improvements

- USDA Rural Development: https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-repair-loans-grants

- National Low Income Housing Coalition: https://nlihc.org/

With thorough research, careful planning, and a bit of patience, you can leverage government programs to transform your home into a space you love, all while staying within your budget.

-

5 Questions to Consider Before Installing Rooftop Solar

As energy costs rise and environmental concerns grow, many homeowners are considering rooftop solar panels as a sustainable and cost-effective

-

How Much Does A Handyman Charge To Paint A Room In Minnesota?

Giving your Minnesota home a fresh coat of paint can breathe new life into a space. But if you’re not

-

How Much Does a Handyman Charge Per Hour in Minnesota (Updated for 2024)

Keeping your Minnesota home in tip-top shape often requires a toolbox full of skills and sometimes, more hands than you

-

Make a Pea Gravel Patio Yourself -What Tools You May Need?

Pea gravel patios offer a charming and budget-friendly way to create an inviting outdoor space. They are perfect for patios,

-

Pea Gravel Patios: A Budget-Friendly But Practical Choice?

Pea gravel patios have become a popular choice for homeowners looking for an attractive and affordable outdoor space. Made from

-

The Curious Case of the Skibidi Toilet Song: A Viral Enigma

The internet is a breeding ground for bizarre trends, and the “Skibidi Toilet Song” is a prime example. While its

-

Home Depot Kids Workshop Registration in Minnesota

The Home Depot has long been a beacon for DIY enthusiasts and home improvement projects. However, what many might not

-

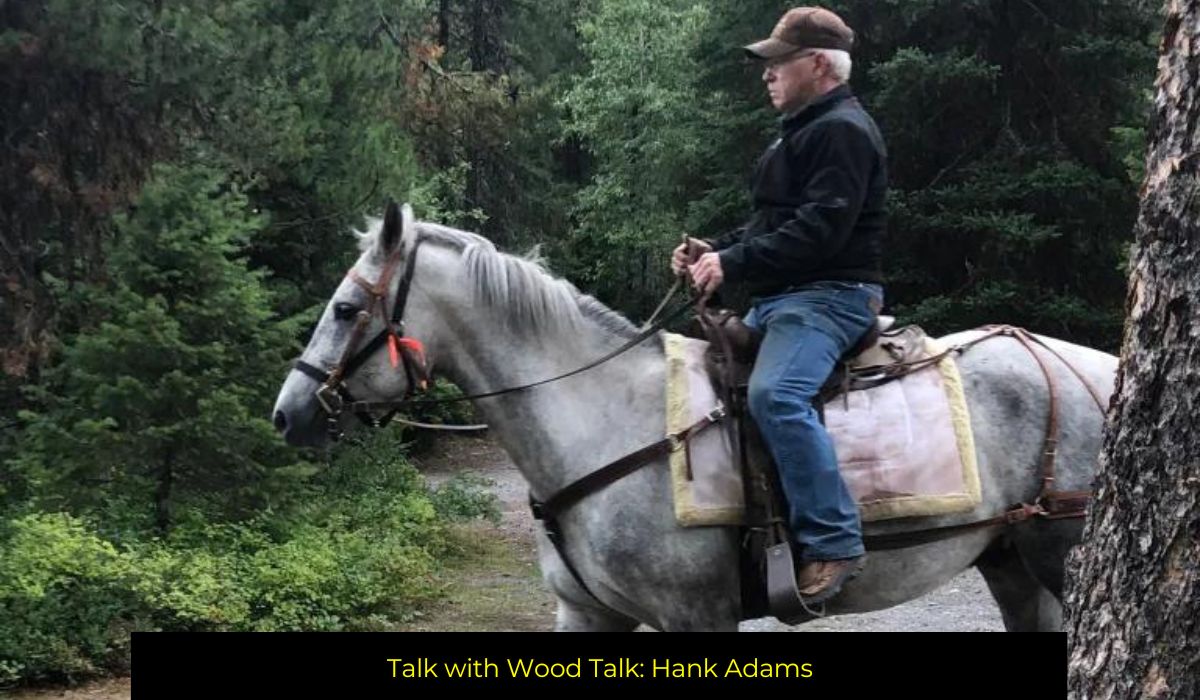

Hank Adams – Interview | Questions Answers

Bison Hardwood is an Arlee, Montana-based distributor. Hank Adams serves as both director of manufacturing and general manager. He owned

-

How to Choose the Right Home Builder in Minnesota?

Selecting the right house builder for your needs can be difficult in many cases. The builder you choose should be

-

Simple Steps to Paint Garage Floor

A freshly painted garage floor can significantly transform your space, making it brighter, cleaner, and more resistant to wear and