A recent housing market analysis indicates that after reaching a record high in 2021, house sales fell back into a 12-year low in 2023.

According to a combined annual report from the Minneapolis Area Realtors and the Saint Paul Area Association of Realtors, home sales decreased in 2023 for the second consecutive year. Just two years after house sales reached a 20-year high in 2021, this year had the fewest sales in the state since 2011.

A lack of available housing stock, growing borrowing rates, and price increases are the main causes of the sales drop. In a news statement on Monday, the groups stated, “The pendulum usually overswings.” The organization used data provided by NorthstarMLS to highlight purchase trends in its yearly report.

In 2022, mortgage rates increased from 2.7% to 8%, almost tripling in value. Rate increases may have reduced purchasing activity, but there was still a scarcity of available homes, which drove up prices. This year, because they would probably have to give up better mortgage rates, sellers were reluctant to relocate and purchasers were apprehensive. Although the average length of time a house is listed for has grown annually, the survey pointed out that this average is still rather short.

According to the press release, Amy Peterson, president of the Saint Paul Area Association of Realtors, “observed many comparable tendencies from the second half of 2022 as rising rates began to weigh heavily on the marketplace.” “We observed a decrease in listings and transactions, but there was an increase in prices, unexpectedly strong offers, and very short market periods.”

Other important information in the report:

- There were 59,581 properties listed by sellers, which is a 12.4% decline from 2022.

- Closed sales for buyers were 44,310, a decrease of 17.6%.

- At $368000, the median sales price increased by 1.4%.

- At year’s end, there were 6,270 units in inventory, a 4.9% decrease.

- The average number of days on the market grew to 40, a 29% rise (median of 18, up 28.6%).

Changes in sales patterns were noteworthy for different kinds of homes. Sales of townhomes were down 9.1%, condominiums 12.8%, and single-family houses down 20%. While new construction sales dipped 3.9%, previously owned sales fell 19.2%. For the year, sales of properties under $500,000 decreased by 17.0%, while sales of luxury residences over $1 million declined by 4%.

According to the survey, monthly payments are the biggest issue that consumers face. The average monthly payment on a median-priced property has increased from around $1,600 to $2,700 since 2020. Instead of paying cash, the majority of property purchasers obtain a mortgage with monthly payments. “Monthly payments count more than price in that sense,” the research states, adding that some customers who downsized to a smaller, less expensive property over the past year would nonetheless be paying higher monthly mortgage rates due to high interest rates.

A sufficient number of well-paying employment are necessary to support the demand for, and monthly payments for, residences. That’s why rates are important in the short run. However, the long-term viability and health of the housing market are ultimately determined by the labor market and economy, according to the research.

Source:

https://tcbmag.com/minnesota-housing-market-whiplash/

-

5 Questions to Consider Before Installing Rooftop Solar

As energy costs rise and environmental concerns grow, many homeowners are considering rooftop solar panels as a sustainable and cost-effective

-

How Much Does A Handyman Charge To Paint A Room In Minnesota?

Giving your Minnesota home a fresh coat of paint can breathe new life into a space. But if you’re not

-

How Much Does a Handyman Charge Per Hour in Minnesota (Updated for 2024)

Keeping your Minnesota home in tip-top shape often requires a toolbox full of skills and sometimes, more hands than you

-

Make a Pea Gravel Patio Yourself -What Tools You May Need?

Pea gravel patios offer a charming and budget-friendly way to create an inviting outdoor space. They are perfect for patios,

-

Pea Gravel Patios: A Budget-Friendly But Practical Choice?

Pea gravel patios have become a popular choice for homeowners looking for an attractive and affordable outdoor space. Made from

-

The Curious Case of the Skibidi Toilet Song: A Viral Enigma

The internet is a breeding ground for bizarre trends, and the “Skibidi Toilet Song” is a prime example. While its

-

Home Depot Kids Workshop Registration in Minnesota

The Home Depot has long been a beacon for DIY enthusiasts and home improvement projects. However, what many might not

-

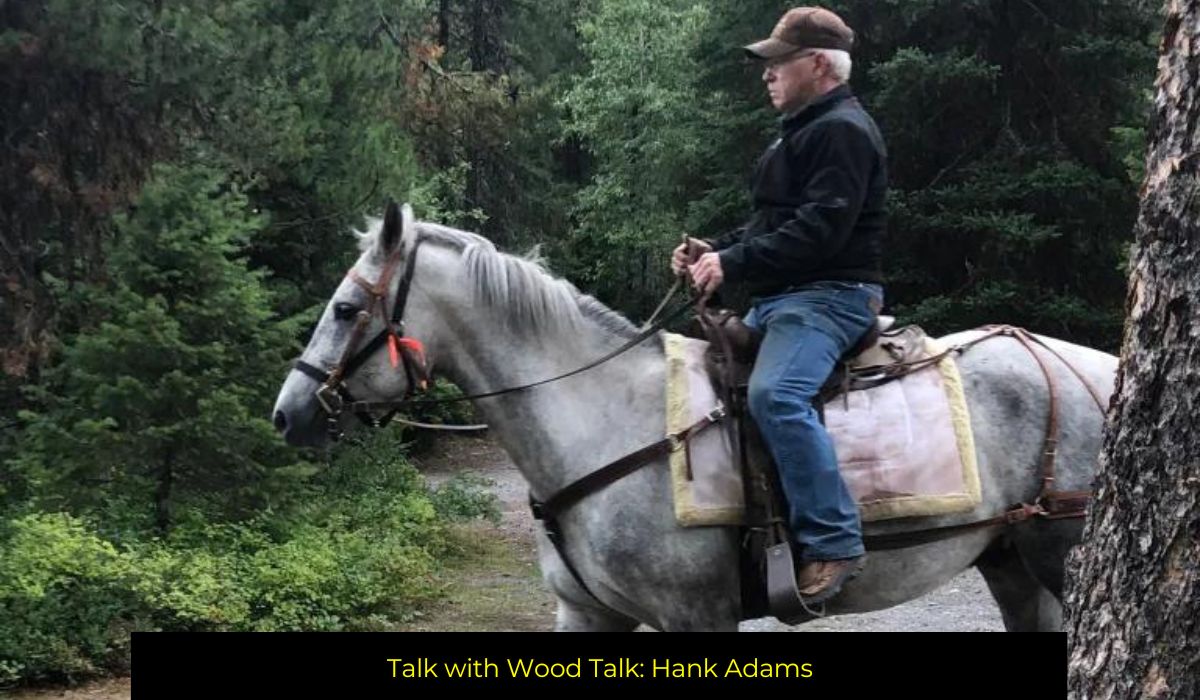

Hank Adams – Interview | Questions Answers

Bison Hardwood is an Arlee, Montana-based distributor. Hank Adams serves as both director of manufacturing and general manager. He owned